|

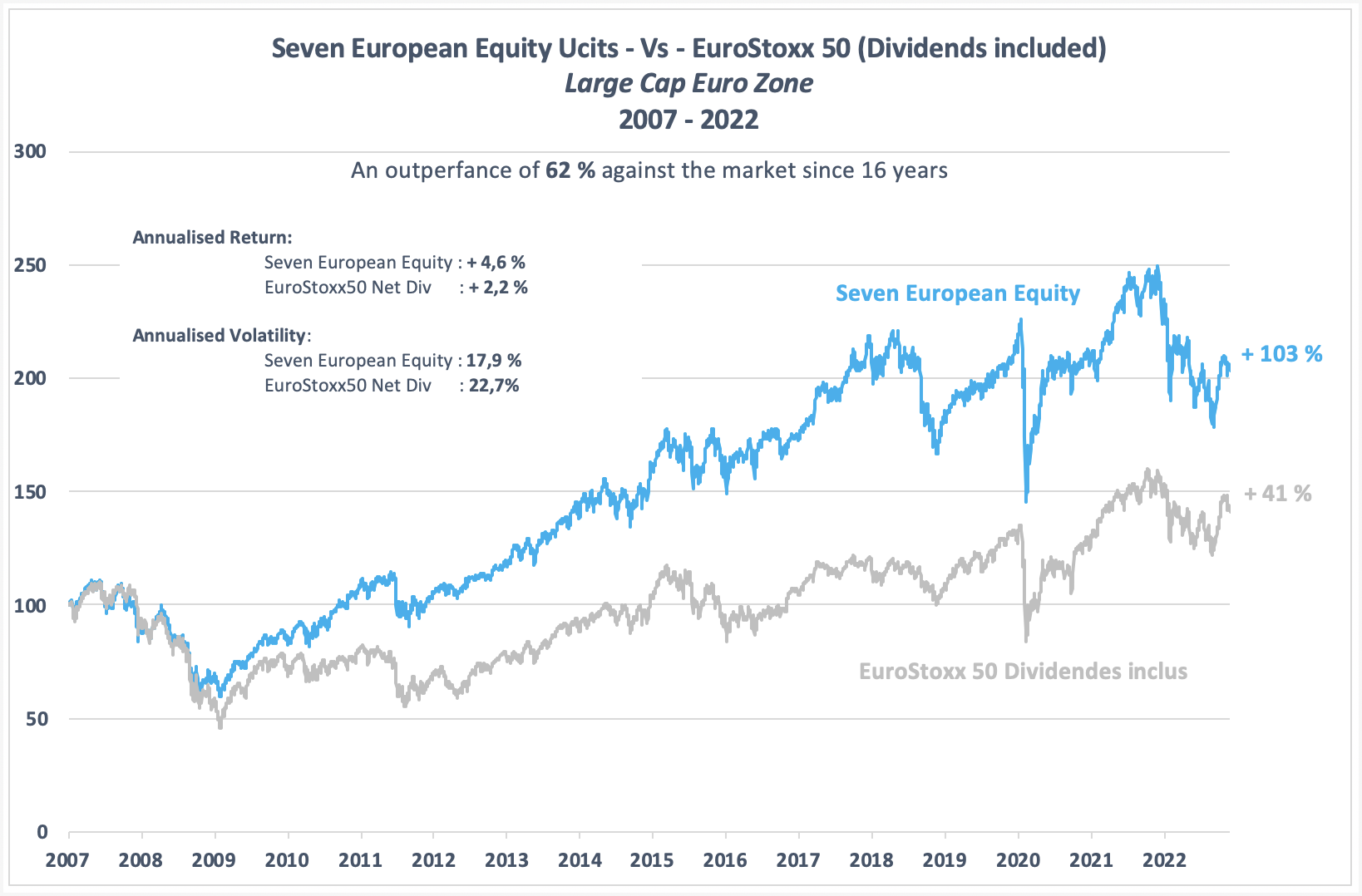

With a 16-year track record, the eurozone large-cap equities fund’s outperformance stands at 62% since 2007 relative to its benchmark (Euro Stoxx 50 (dividends included)). The Momentum-based stock-picking process combined with the Dividend Yield strategy brings a high degree of diversification to equity components.

Dear Investors,

2022 – a tough year for the equity asset class – allows us to make an in-depth long-term analysis of the Seven European Equity fund’s behaviour compared with its benchmark, the Euro Stoxx 50 (dividends included).

Firstly, analysing its returns since its launch at the beginning of 2007 (graph below) demonstrates the strong capacity of selecting securities based on Momentum (combined with the dividend yield since April 2022) to generate outperformance relative to the large-cap stock market. After 16 years, the fund’s performance stood at +103% versus +41% for the Euro Stoxx 50 (dividends included), i.e. a net outperformance of 62% over the period. In addition, investing mainly in large caps provides the fund with maximum liquidity, a crucial point for any investor.

Let’s go further in the analysis – Let’s examine the 4 key points of an equity investment:

- The complementarity of Momentum vs. Value/Growth

- Study of changes in beta

- The capacity to create alpha and the assessment of alpha

- Analysis of performance relative to the benchmark

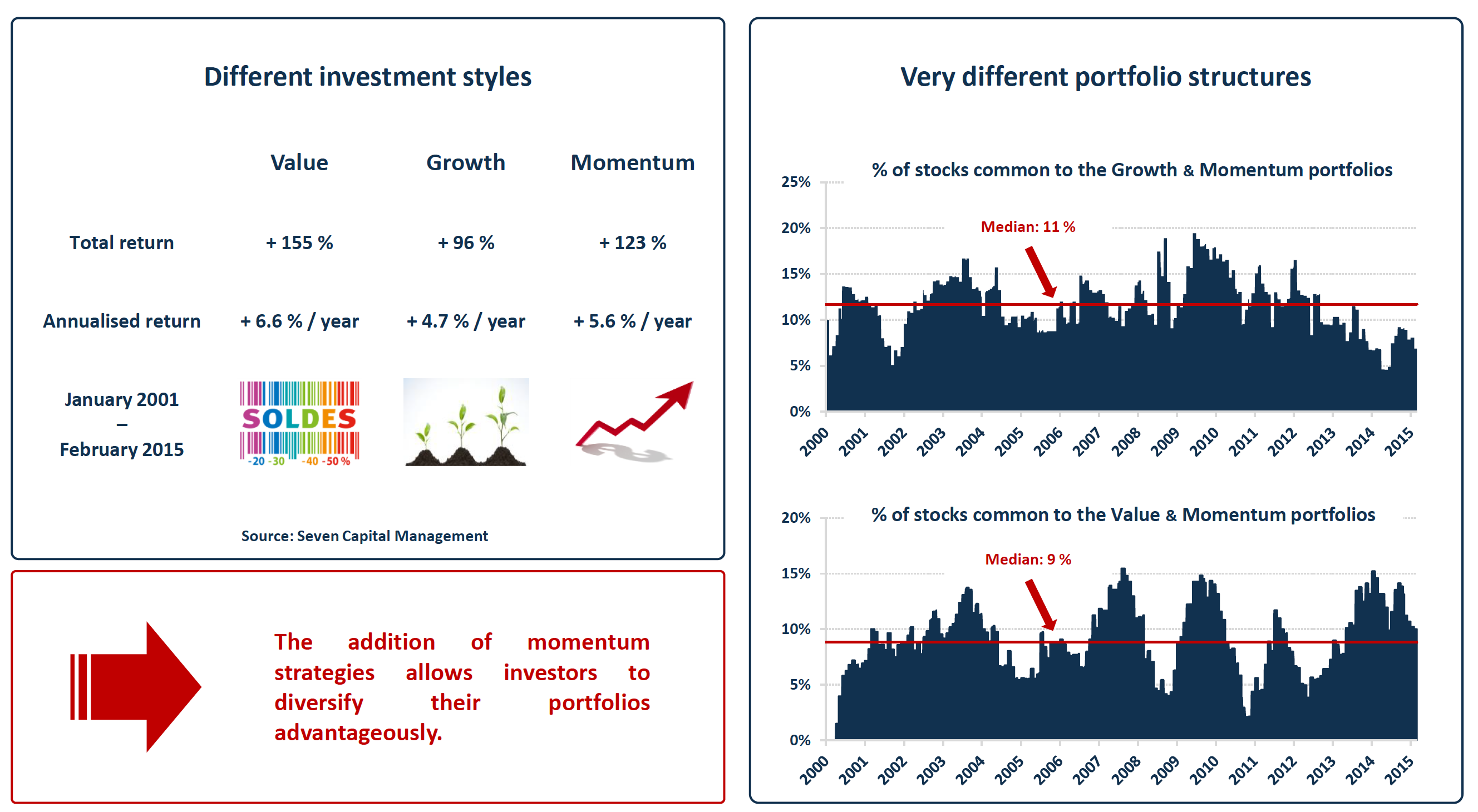

The complementarity of Momentum vs. Value/Growth

Investors must diversify their positions within the same class in order to create added value. Compared with the two major families of shares, namely Value shares and Growth shares, incorporating a Momentum-type component brings a very high degree of diversification, as the portfolio compositions of Seven European Equity and the two major families are very different. On average, they only have 10% of securities in common, which confirms the high degree of diversification and therefore the very high added value of combining the different approaches.

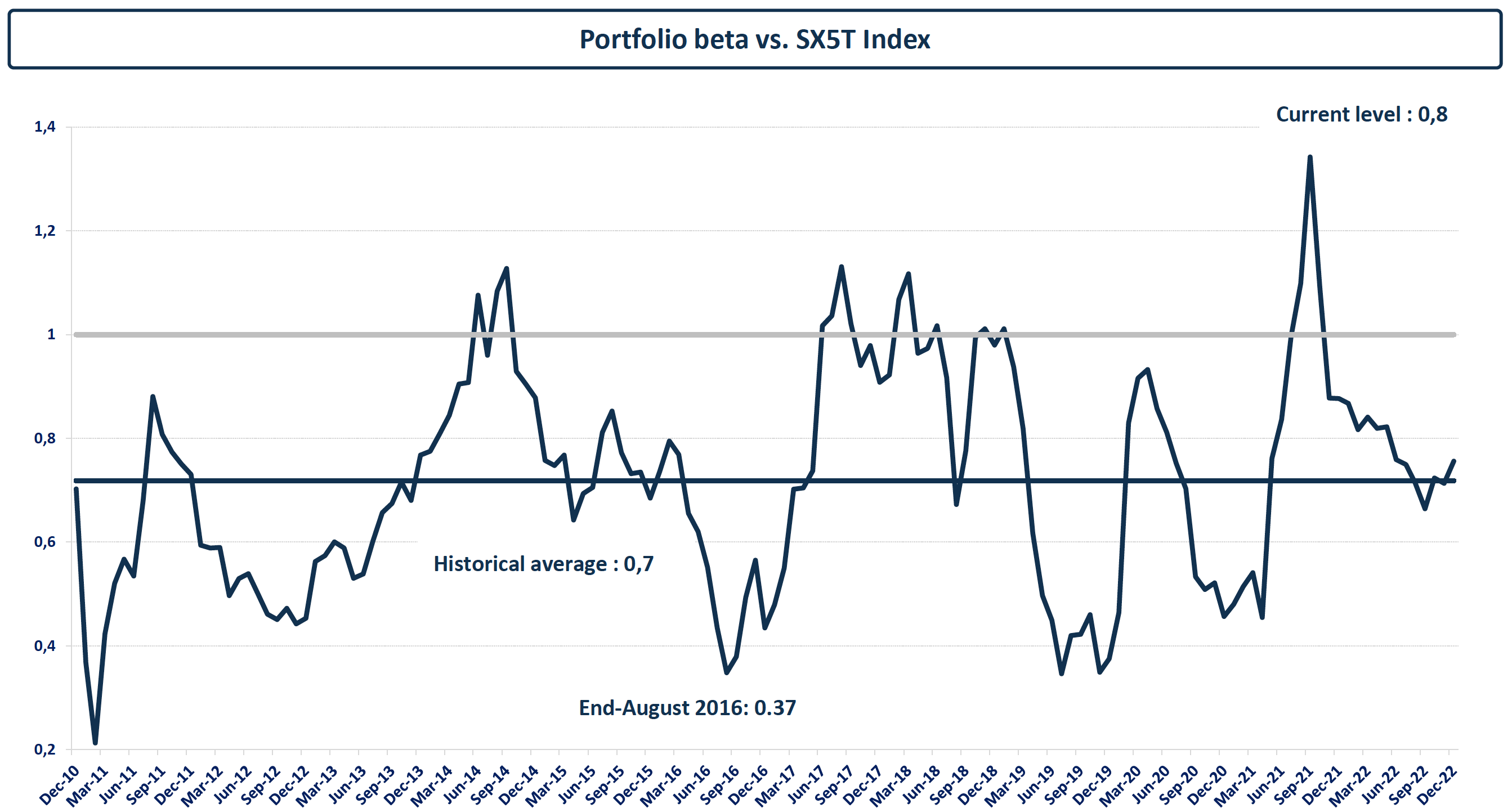

Analysis of changes in the fund’s beta relative to the market

Active management is represented by the beta’s variability relative to a benchmark. This is where the much sought-after alpha is created. There is no point in investing in a fund unless it adds value to a portfolio; if it’s to make the market, then you might as well buy a tracker. The graph below shows the significant variability of the fund’s beta relative to the market, dropping to as low as 0.2 in 2011 and even rising to 1.35 in 2021. This variability shows how the Momentum stock-picking process can position itself on sectors that have or will have the best chance of outperforming, and thus creating alpha.

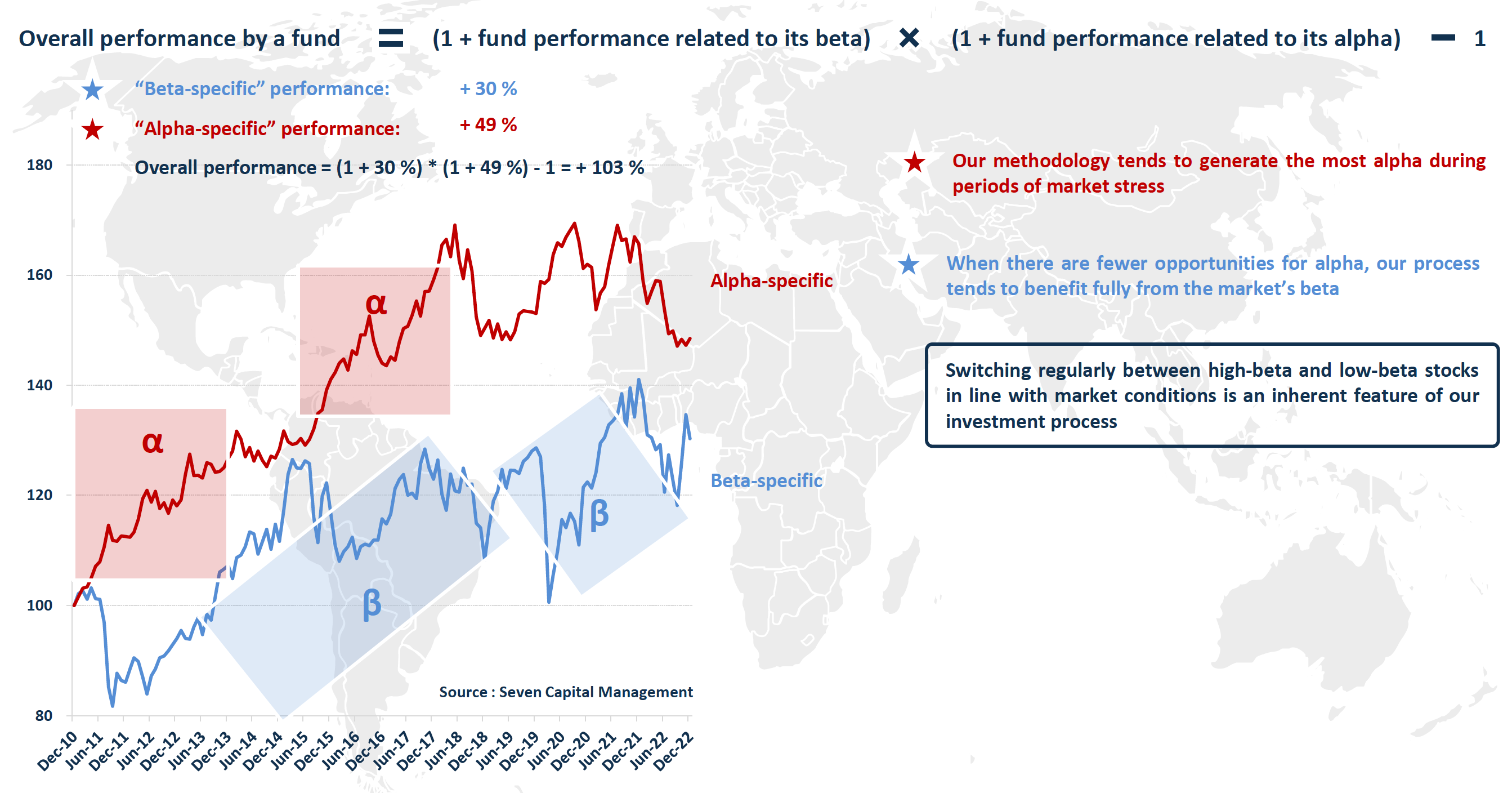

Creating and assessing alpha

A fund’s performance comprises the performance generated by the market itself, plus the outperformance of the manager or the management process. Therefore, we must separate the two to fully understand and analyse the creation of value.

The overall performance of a fund is therefore equal to:

(1 + the fund’s beta-related performance) * (1 + the fund’s alpha-related performance) – 1

The graph below shows the breakdown between beta-related performance (labelled as Beta Specific) and alpha-related performance (value added by the manager, labelled as Alpha Specific).

Here, the total performance created by the fund (103%) since its launch was due in large part to alpha, i.e. the added value created by the manager.

IMPORTANT: a management process that uses Seven algorithms for stock-picking means stability can be ensured throughout. It is in no way subject to adverse human factors, such as fear, overexcitement, anxiety, stress and manager turnover in particular, which is the most common factor and can undo a track record.

Let’s delve further and project ourselves into the future.

The important thing for investors is being able to assess the future and how they can expect their investments to behave.

Here, we are going to examine three key aspects of an equity investment:

- On average, what is the expected outperformance for the investment?

- What is the probability that it will outperform?

- By unit of risk of underperformance, how many units of outperformance can be expected? This ratio, known as omega, allows investors to assess the added value of their portfolio managers.

As equity investments tend to have a five-year horizon at least (7 to 10 years is better), we will analyse the data over this period.

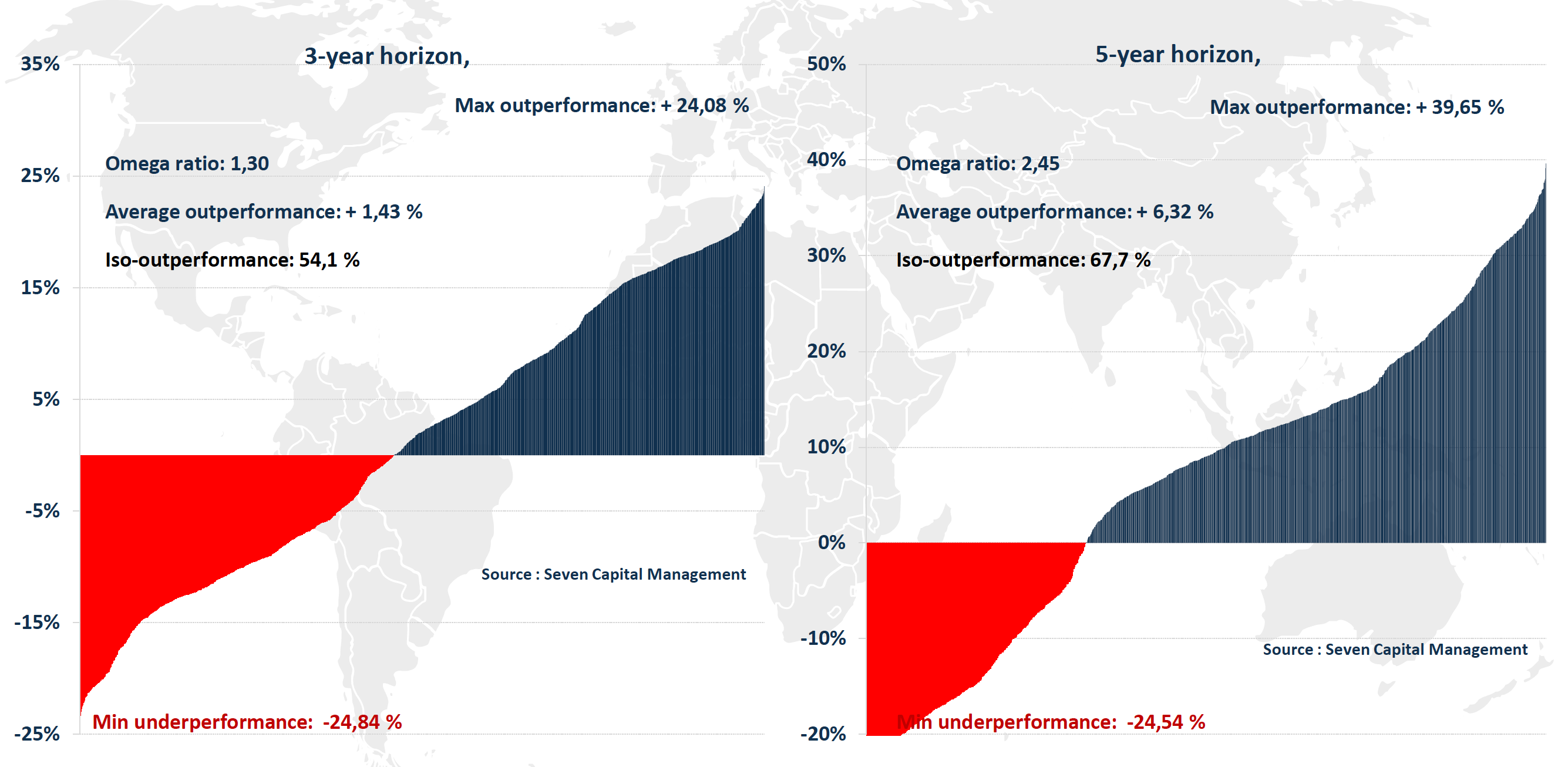

The graph below represents the over and underperformance of the fund over a five-year rolling period since 2007 compared with its benchmark, which in this case is the Euro Stoxx 50, dividends reinvested.

- Firstly, the average outperformance over a five-year rolling period since 2007 is +6.32%

- The Iso-Outperformance point is 67.7%, i.e. a probability of almost 70% (7 chances out of 10) of outperforming the benchmark over an investment period (five years, in this case).

- The Omega Ratio over a five-year period is 2.5. For each unit of risk of underperformance – given that, for equities, we assess over and underperformance compared with a benchmark index – investors receive 2.5 units of outperformance (the blue area representing the outperformance is divided by the red area representing the underperformance).

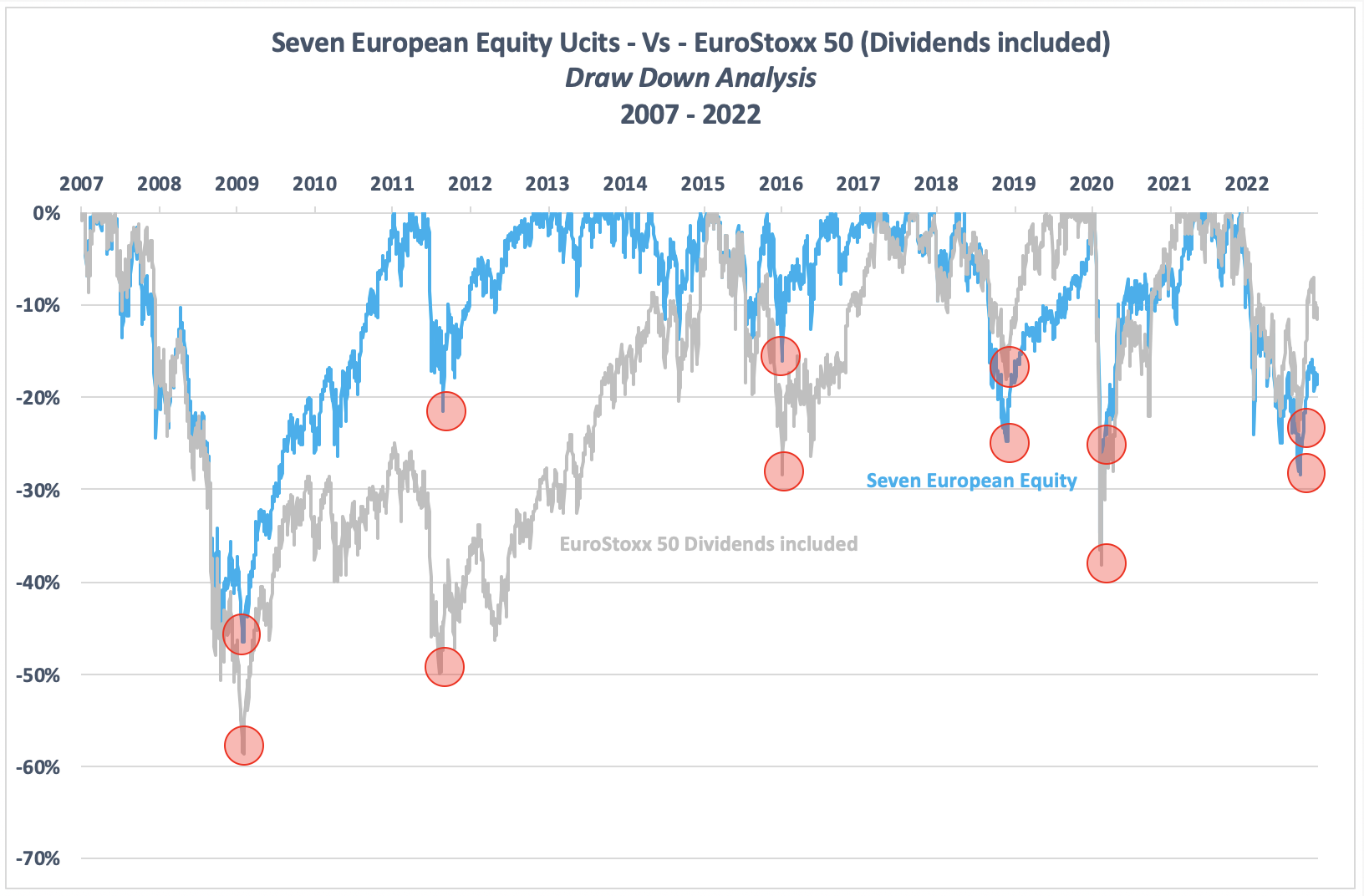

Analysis of historical lows of Seven European Equity:

It is important to analyse any falls by the Euro Stoxx 50 market and the fund, as this is where the risk of capital loss can become apparent. Below, we can see the extent of these falls, the ability to make up for them, and the time it takes to retrace the decline. On the graph below, we see that the market recorded its worst underperformance (-60%) in early 2009, with this decline lasting eight years (2007 to 2015), whereas the fund posted a 45% decline and took only four years to retrace it.

Conclusion :

The importance of diversification and the ability to create alpha is central to an equity allocation. Over the long term, Seven Capital’s equity management has demonstrated its exceptional ability to outperform its benchmark. Due to its type of management, Seven can guarantee investors stability and reproducibility due to the disciplined and rigorous management process.

Seven Capital’s equity management is accessible through its UCITS fund but also through mandates and certificates, which means there are no investment ratio constraints.

Thank you again for your trust and the entire team wishes you a happy new year.

NB: from 2007 to 2010, the track record used was the long-only part of the portfolio.

|