|

Seven Absolute Return Momentum Index : – For qualified investors only - is a Certificate issued by Natixis replicating the Long/Short multi-asset class strategy of Seven Capital. The investment process is based on an analysis of the medium and long term trends in the prices of financial assets as well as their risks. The target volatility of the certificate is 10%. The Certificate invests in interest rate markets and global equity markets through futures contracts.

The certificate (AMC: Active Managed Certificate) offers daily liquidity.

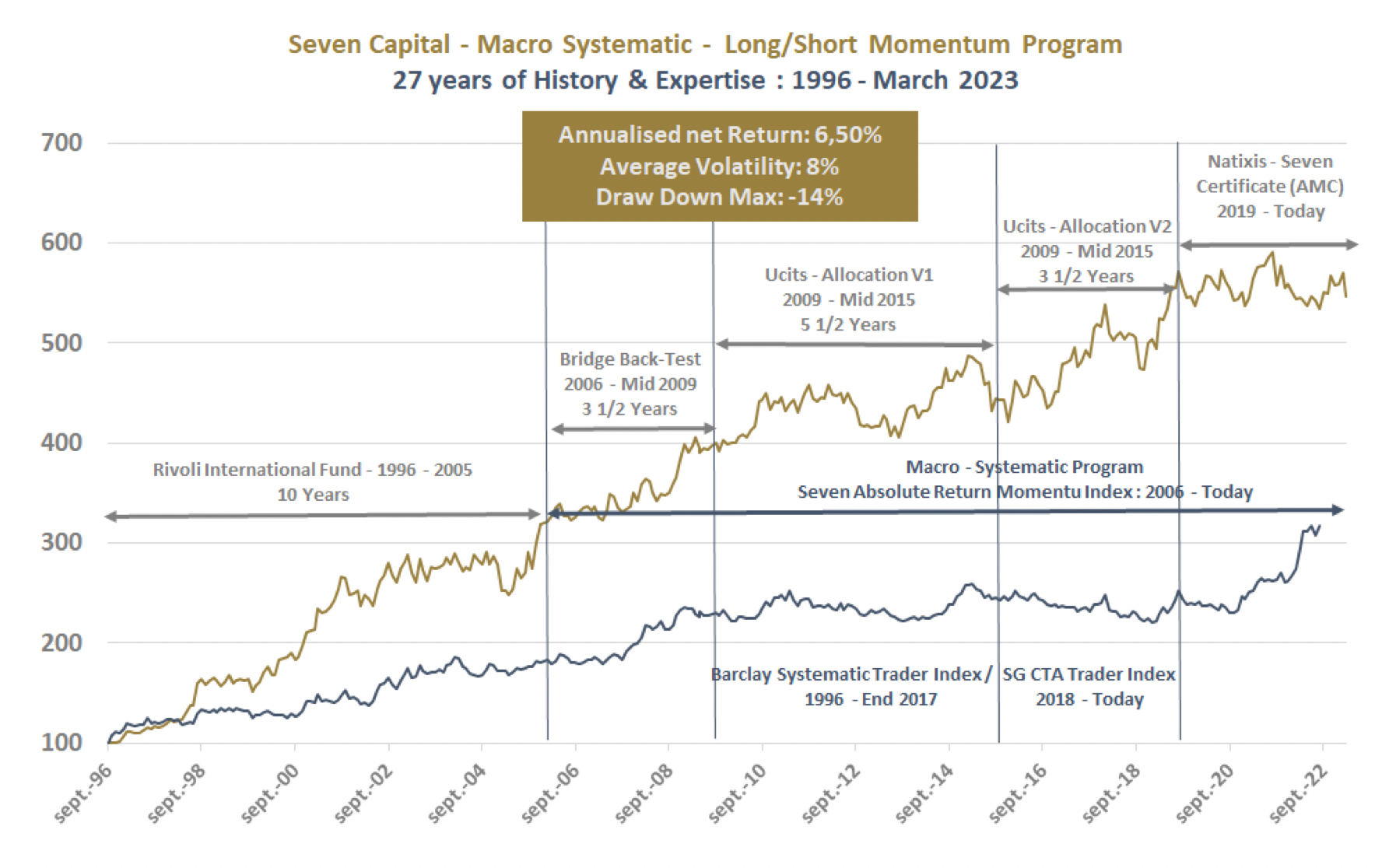

Seven Capital has one of the longest track record on this strategy in Europe with 27 years of management.

Risk analysis makes it possible to calibrate the maximum draw Down target for a given return target. The certificate targets a regular return objective linked to the objective level of volatility of 10%.

The investment process is based on an analysis of market trends called “Momentum”. This trend analysis is applied to macroeconomic data, the prices of financial assets and their intrinsic risks. These make it possible to determine the bullish and bearish trends of the markets. The investment universe covers government bonds and international equity markets.

- Annualised Return Target : 10 %

- Volatility Target : 10 %

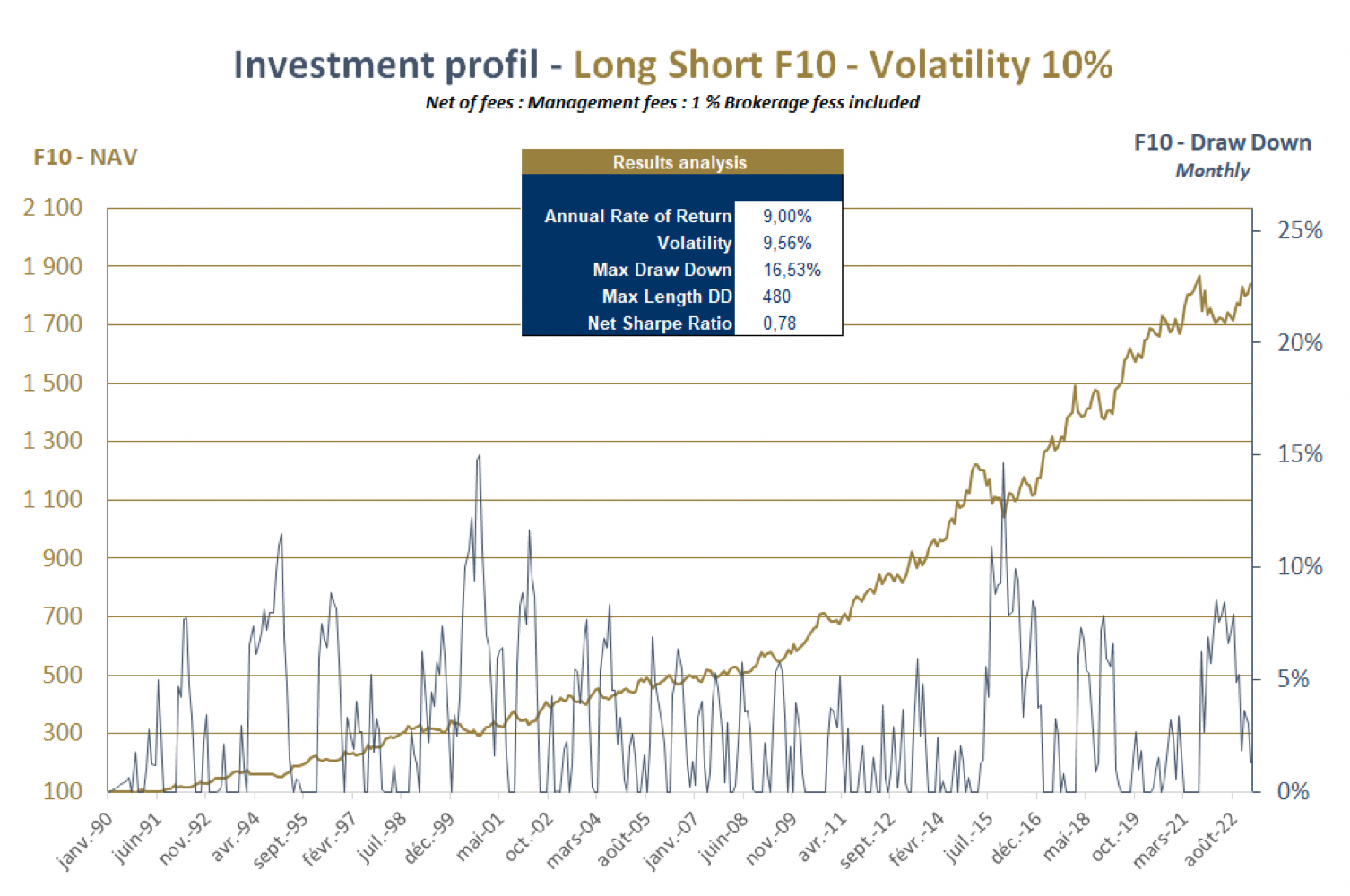

The long-term analysis made possible by the data processing capacity of our system makes it possible to simulate very precisely the evolution of the value since 1990, thus making it possible to have a long-term vision of the management process. This simulation confirms the objectives assigned to the management program under the constraint of its target volatility, in this case 10%.

Any investment is associated with a return target and a risk of capital loss. The absolute return approach of our management process makes it possible to systematically restore new historical highs. Any decline in the value of the product is therefore an investment opportunity. In monthly data, the maximum decline target is around 15%.

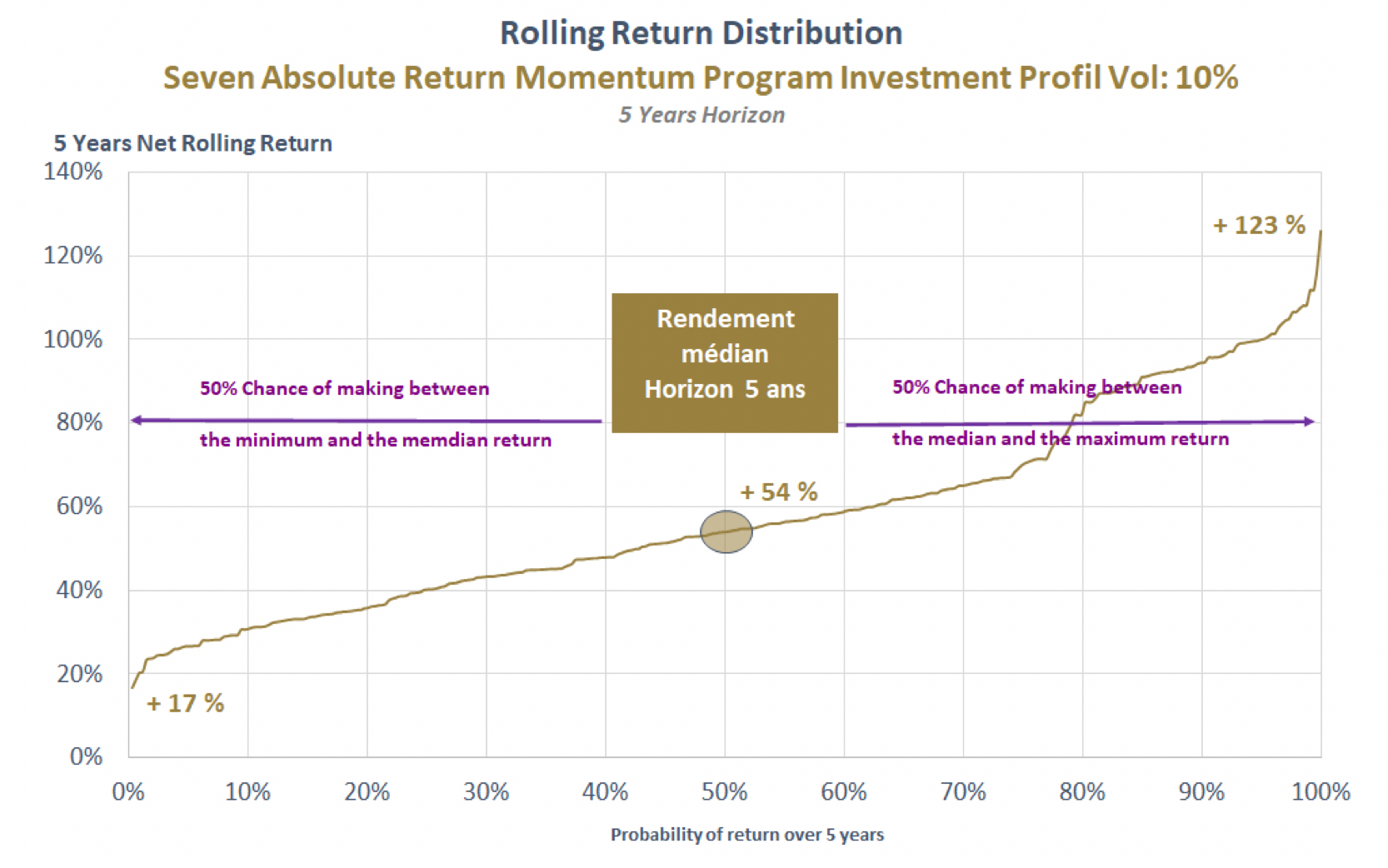

The analysis of rolling 5-year returns allows the investor to assess the potential returns as well as the risks over this period. Median return objectives for the Absolute Return Momentum index program over a 5-year horizon: +54%

The Seven Capital teams are at your disposal to answer your questions.

|