|

Dear Investors,

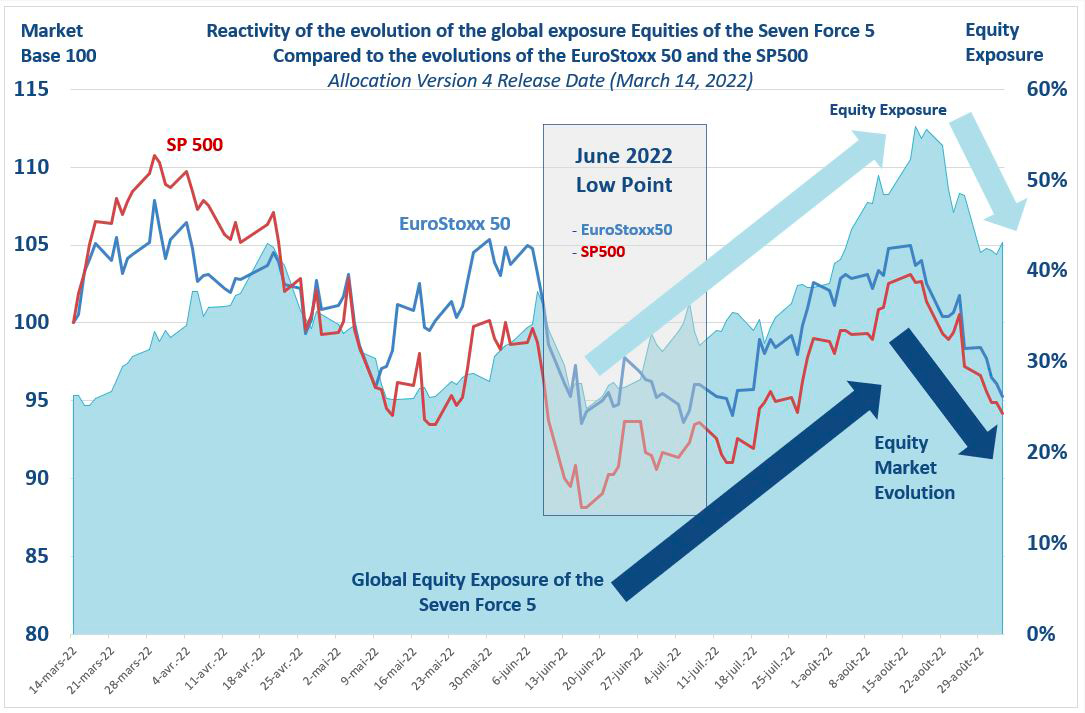

Reminder: the main characteristic of the V4 allocation method in the Seven Force range is its ability to take on risk on market lows des marchés but also to disengage from markets that go into correction or become deeply bearish.

Following the violent fall in the equity markets since mid-August, -8.42% for the EuroStoxx50 and -8.28% for the SP500 (from August 17 to September 2, 2022, i.e. over 12 days), equity exposure fell from 56% to 41%, ie a 27% drop in equity exposure over the period.

This capacity for real flexibility is the DNA of the Seven Force range and gives it this specificity of Absolute Return. The market sequence that we have experienced from June 2022 to today with the rise and then the fall of the markets shows the full effectiveness of version 4 of the allocation methods implemented since March 2022. It represents a real technological advance in the field of allocation and risk management allowing Seven Capital to approach the future years with conviction and confidence.

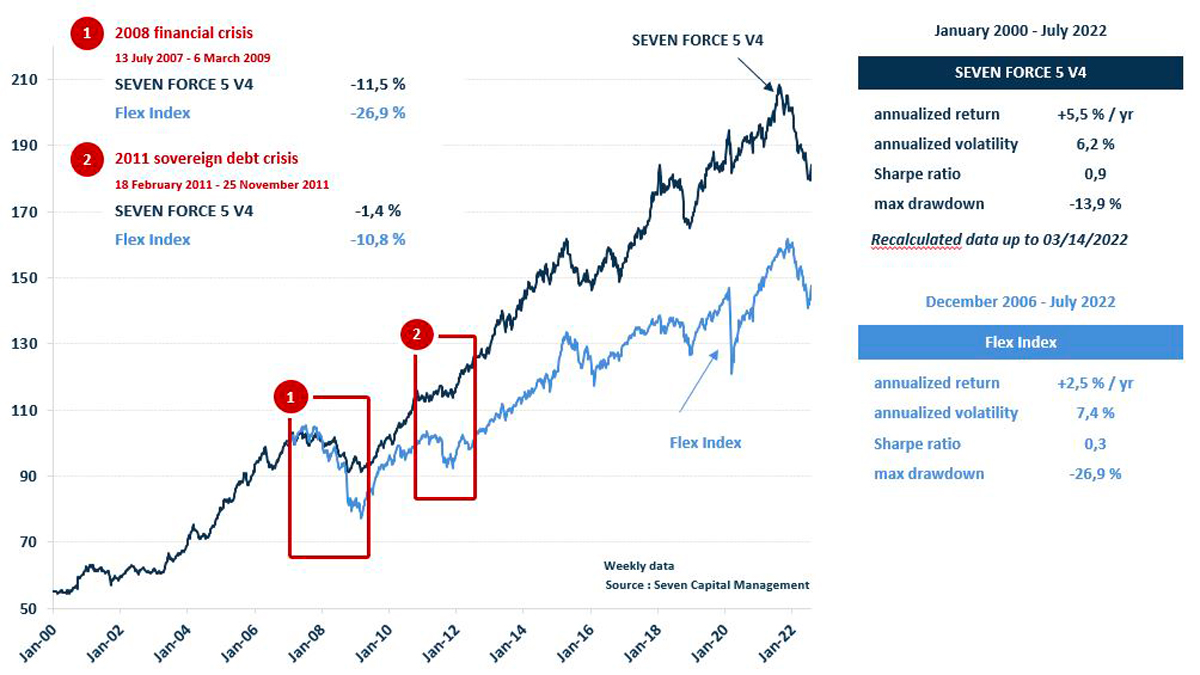

As a reminder: The Seven Force 5 V4 over a long period

We remain at your disposal for any further information.

|