Dear Investors,

Seven Force 2 and Seven Force 5 version 4 allocation methods are now well integrated. As a consequence we wanted to provide a quick technical explanation and update as of Monday, May the 9, 2022.

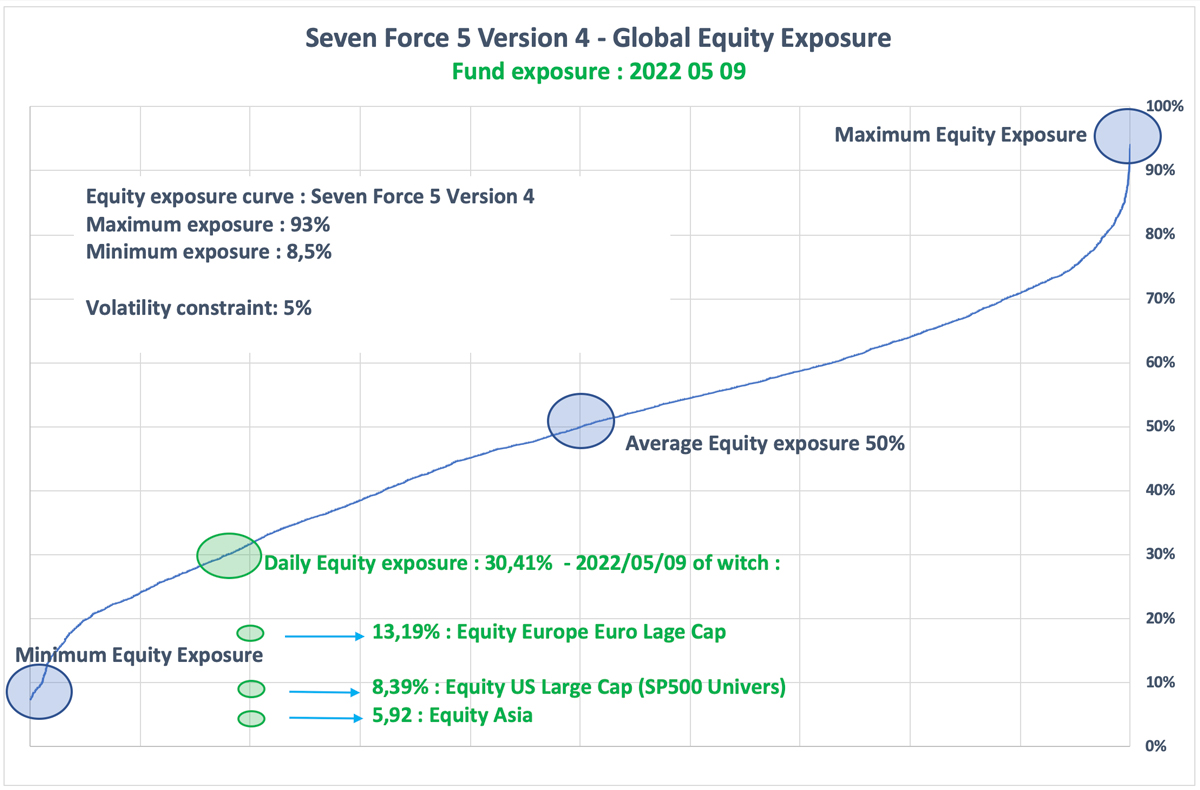

On the graph below you will see the curve of global equity exposure (Europe/USA/Asia) from its minimum allocation (8.5%) to its maximum allocation (93%). The fund's median exposure to equities is 50%, identical to version 3. The volatility-constrained allocation set at 5% for the Seven Force 5 (2% for the Seven Force 2) now allows more flexibility in the allocation management.

Like our momentum processes, this constraint is applied with rigor and discipline. The maximum exposure, can now rise above the 65% maximum of version 3 and therefore benefit from much more amplitude and deliver higher performance than version 3 while keeping its downward flexibility during long bear markets.

As of Monday May 9, 2022, equity exposure is 30,41% broken down between geographic areas as specified in the graph below.

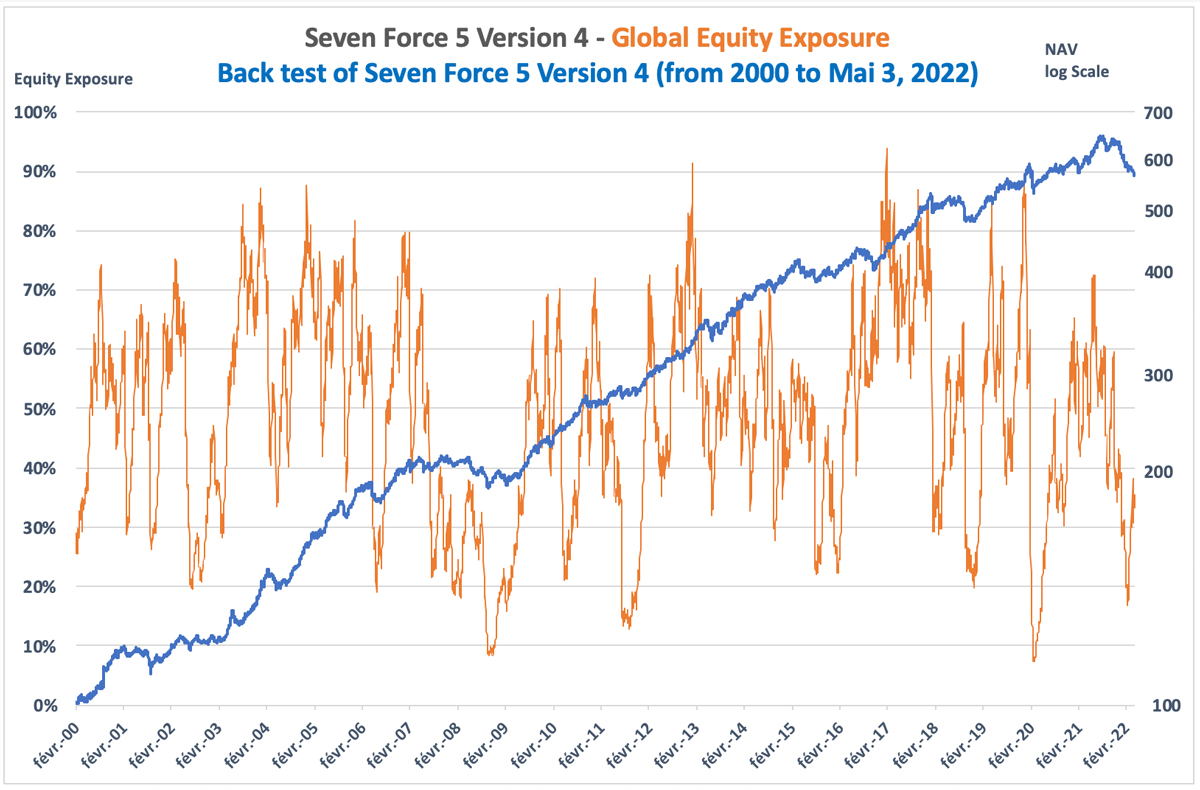

The graph below shows the evolution of the global equity exposure of Seven Force 5 Version 4 since 2000 and the Backtest of version 4 over the same period. We can see the strong flexibility of the fund's exposure to the equity class with a Maximum at 93% (2017) and a minimum at 8.5% in March 2020 (Covid).

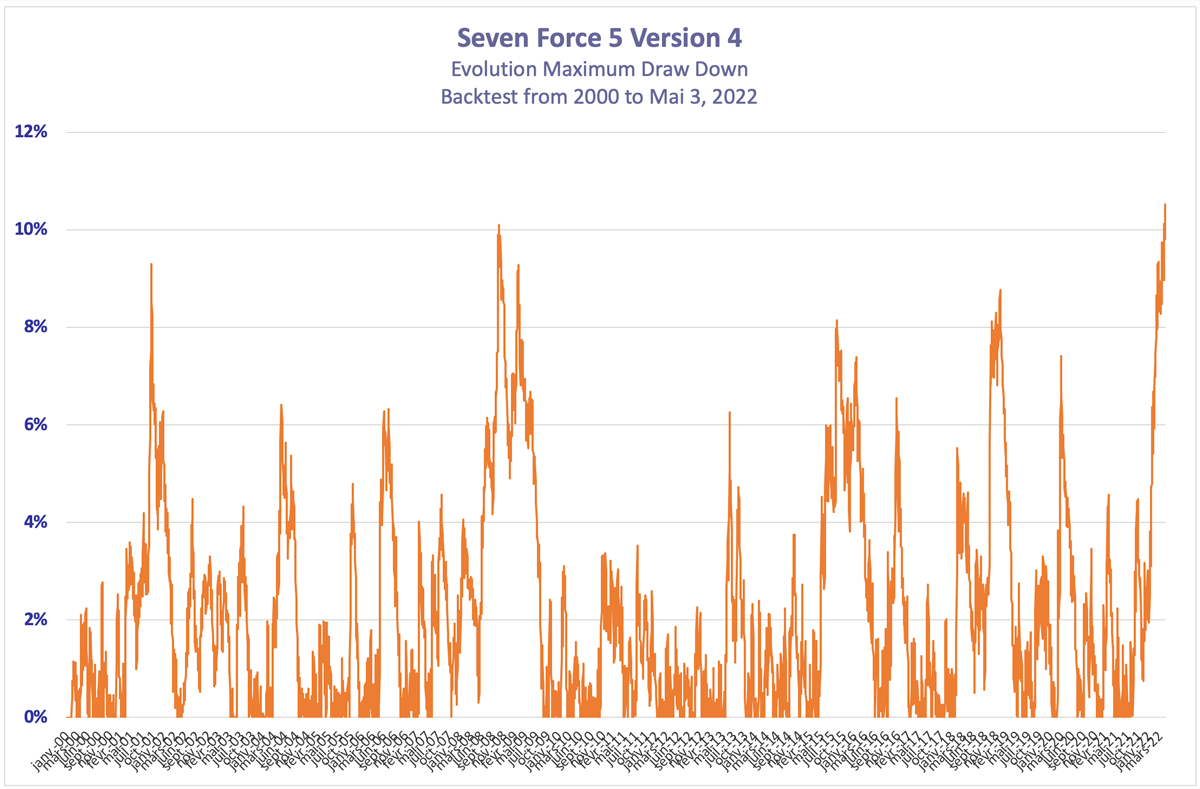

The particularity of Momentum strategies is their ability to establish, with regularity, new historical highs and to erase setbacks. On the graph below we see that the current level (-10.3%) clearly constitutes an opportunity, knowing that the implementation of version 4 allows greater responsiveness and therefore faster recovery following declines. This peculiarity is also found in the Seven Force 2 which currently presents the same opportunity.

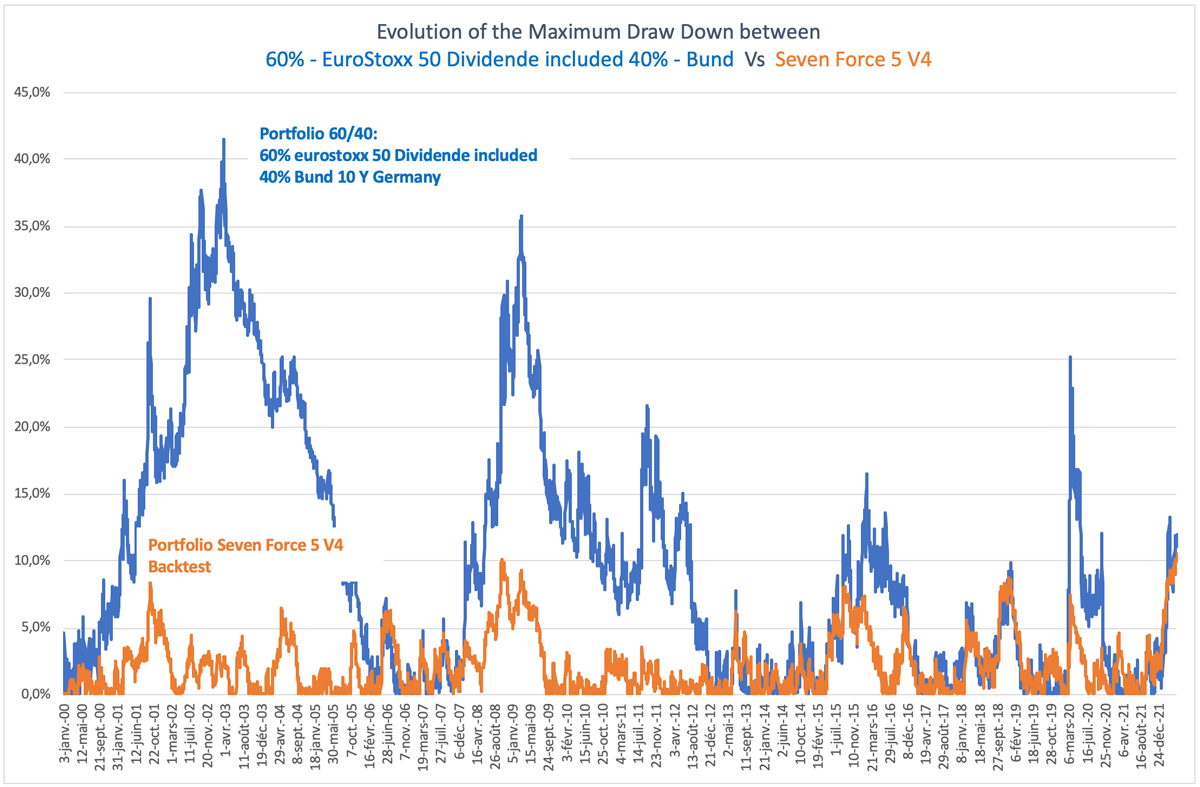

As a reminder, the graph below illustrates the added value of Seven Force 5 Version 4 in terms of risk management versus a 60% Equity allocation (EuroStoxx 50 Dividends included) / 40% (10-year Bund) Bond.

We see here the declines of the 60/40 exceeding 30% to 40% with long recovery periods (6 years). If the current decline remains significant, it remains perfectly within its range of -10% + - 30%.

The Seven Capital team remains at your disposal for any questions you might have.

|