|

Dear Investors,

Version 4 of our allocation process is a significant step forward for our range of funds, Seven Force.

It provides more responsiveness and a greater capacity for larger exposure to the asset classes making up our rates & equities portfolio, particularly on the equities.

Our historical momentum strategies are unchanged.

The upgrade from Version 3 to Version 4 was decided following a positive conjunction of various elements:

- The current Draw Down levels of the two versions were substantially identical, around -9%, and thus allowed a good risk levels juxtaposition of the two versions. (Draw Down: drop in net asset value from a historical high)

- Both versions came out of all-time highs at the end of December 2021.

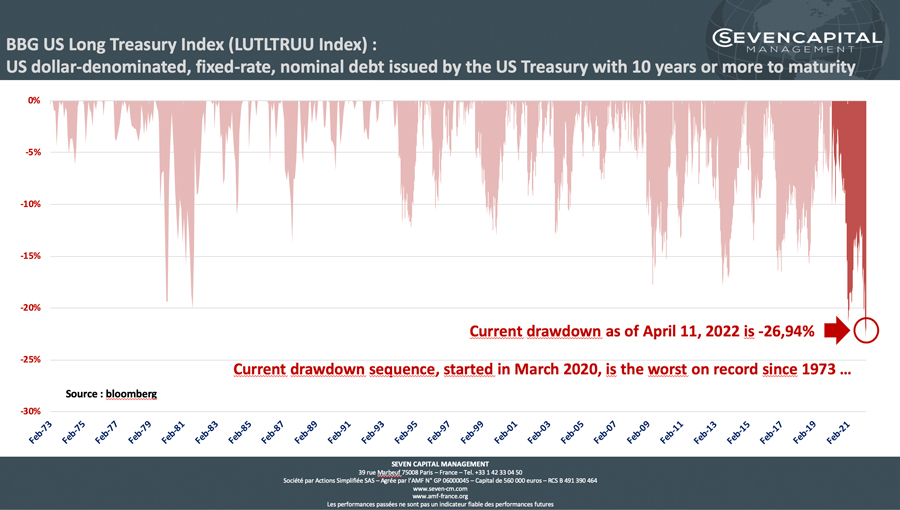

- The reintroduction of the interest rate pocket (German, US & Japanese Government Bonds curves), up to 35% of our maximum commitment capacity on this asset class, made sense given the recent behavior of US Treasuries. Indeed, their last Draw Down, which started in March 2020, has exceeded all declines since 1973, including that of -20% at the end of the 1970s and the beginning of the 1980s following the second oil shock (see graph below).

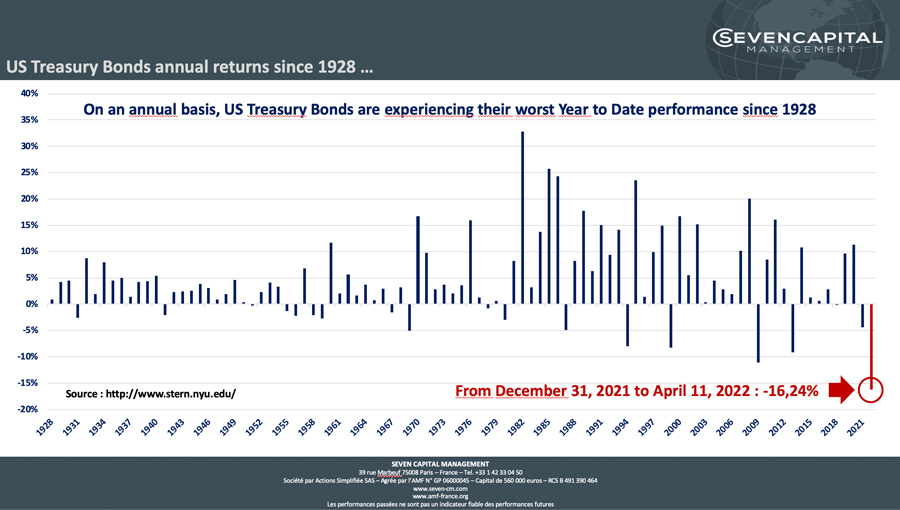

It should also be noted that US Treasury Bonds are having their worst start to the year since 1928, which also pleaded in favor of the reintroduction of this Government Bonds pocket at these levels. (See graph below)

For 15 years, the DNA of our momentum management has been characterized by an ability to systematically post new historical highs, with any decline ultimately presenting an opportunity to invest in funds from the Seven Force range.

The implementation of Version 4 of our allocation methods now allows an acceleration of the speed of recovery following Draw Downs and a reduction in the amplitude of the net asset value contraction phenomena suffered by the fund.

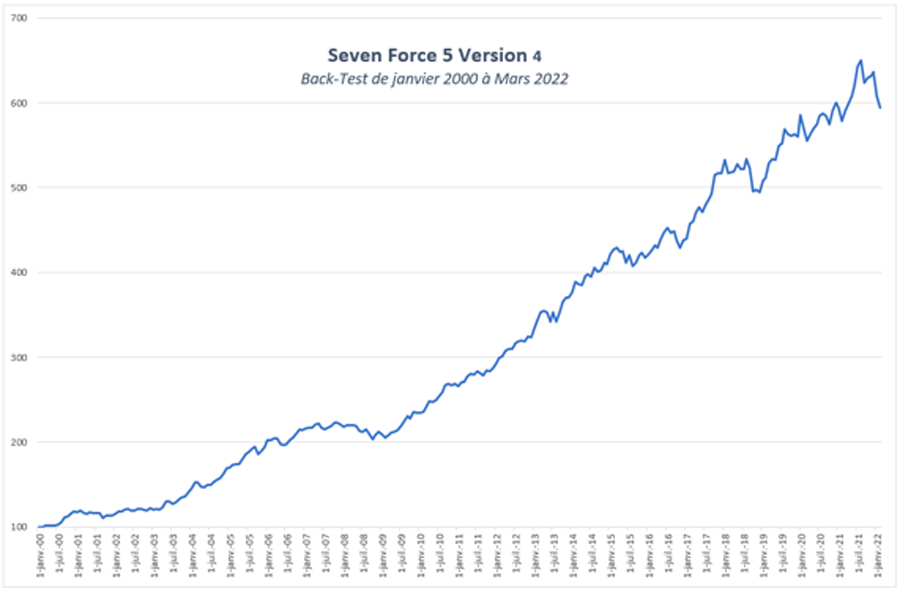

This is clearly visible on the historical chart below, the fund having systematically made new historical highs.

The graph above is the track record of the Seven Force 5 fund cumulating:

- Version1 : 2007 – 2016

- Version 2 : 2017 – 2019

- Version 3 : 2020 – mid-March 2022

- Version 4 : active

Below is the back test of Seven Force 5 in its version 4 from 2000 to March 2022, the contribution of Seven Capital technologies in terms of responsiveness and regularity being significant here.

The version 4 implementation was also carried out on the Seven Force 2 at the beginning of April.

Would you require any further information, the Seven Capital team remains at your service.

|