|

Dear Investors,

Reminder: the main characteristic of the V4 allocation method is its ability to take on risk on market lows.

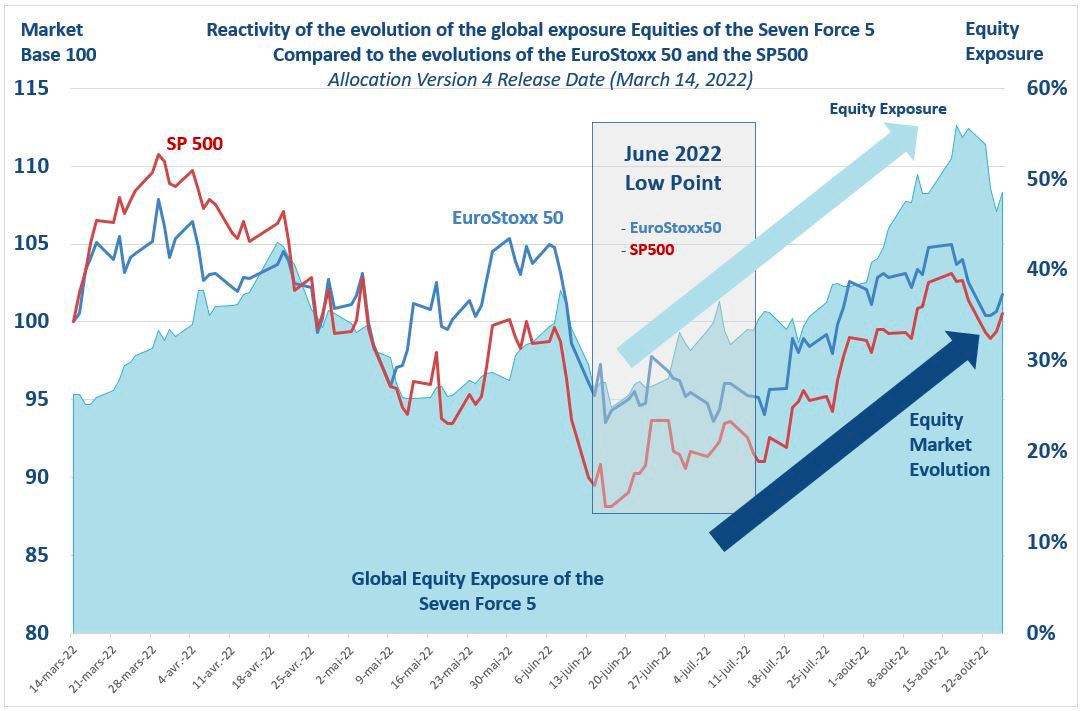

The recovery of the markets from July to Mid-August allows an initial analysis of the responsiveness of the V4 allocation model.

This gave full satisfaction.

The low level of equity exposure (24.81% on June 17, 2022) coincided perfectly with the low point of the European and US equity markets.

During the recovery of the equity markets from July to mid-August, the portfolios perfectly matched the rise in stock market indices, gradually taking on risk in correlation with the rise in equities, rising from 24.81% to 56% on August 17, then, returning to 48% exposure on August 25, following the correction in the second part of the month.

V4 thus shows the relevance of its implementation while bearing in mind that there is no miracle recipe and that in the event of a violent correction, while the systems are measuring the paradigm shift, the funds will suffer for a little while. On the other hand, the V4 allocation methodology has, on this market sequence, perfectly demonstrated all its effectiveness in its ability to take on risk.

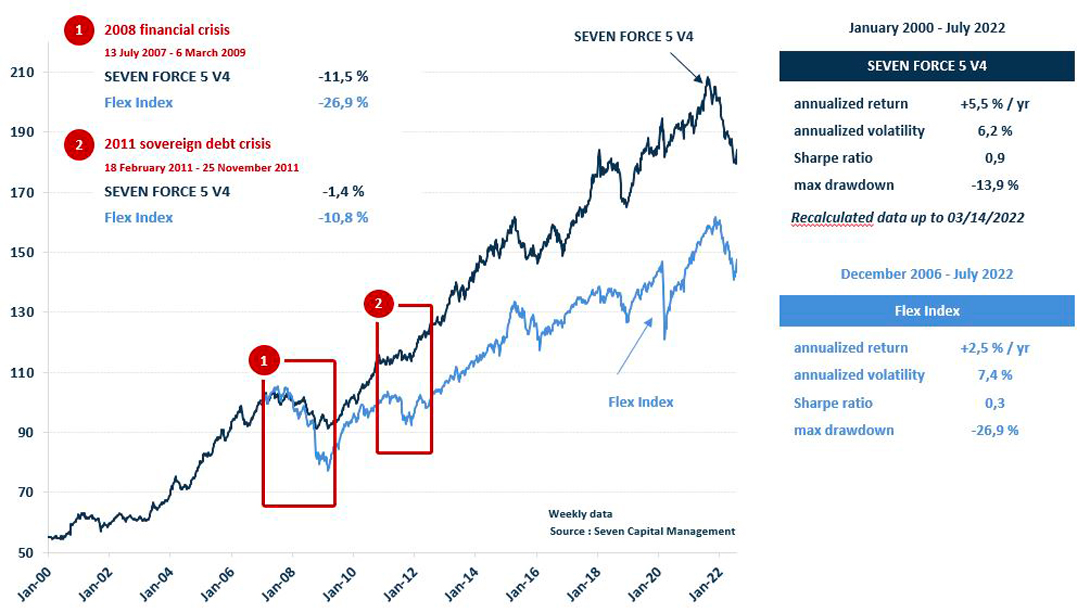

As a reminder: The Seven Force 5 V4 over a long period

We remain at your disposal for any further information.

|